Social Security Income Payment Schedule 2024 Form

Social Security Income Payment Schedule 2024 Form. Download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. The maximum amount for 2024 was boosted from $914 to $943, or from $1,371 to $1,415 for.

The social security administration has shared the social security benefit payment schedule for 2024. Your 2023 tax form will be available online on february 1,.

Download A Copy Of Your 1099 Or 1042S Tax Form So You Can Report Your Social Security Income On Your Tax Return.

Payments are made on the same day of each month according to the schedule established by the ssa.

Supplemental Security Income (Ssi) Is An Important Source Of Income For People In Need.

For people who started receiving benefits before may 1997 or people who receive both ssdi and ssi, the ssa will deliver ssdi.

Here Are The Exact Social Security.

Images References :

Source: leonorazkaia.pages.dev

Source: leonorazkaia.pages.dev

Calendar For Social Security Payments 2024 Dorry Gertrud, These beneficiaries will be the first. This is a comprehensive guide to the social security payment schedule for 2024 including an explanation of each social security program and the date you can expect your payment.

Source: www.2024calendar.net

Source: www.2024calendar.net

Social Security 2024 Calendar 2024 Calendar Printable, If you file your income tax return as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits. (1) provisional income ($31,980) minus lower threshold ($25,000) times.

Source: guiderman.com

Source: guiderman.com

SASSA Payment Dates for 2023/2024 Everything You Need to Know » Guider Man, If you’re thinking when is my social security payment for april 2024 coming? Your 2023 tax form will be available online on february 1,.

![Social Security Wage Base 2021 [Updated for 2023] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png) Source: www.uzio.com

Source: www.uzio.com

Social Security Wage Base 2021 [Updated for 2023] UZIO Inc, For people who started receiving benefits before may 1997 or people who receive both ssdi and ssi, the ssa will deliver ssdi. Here’s a breakdown of all of the social security payment dates for march 2024:

Source: directexpresshelp.com

Source: directexpresshelp.com

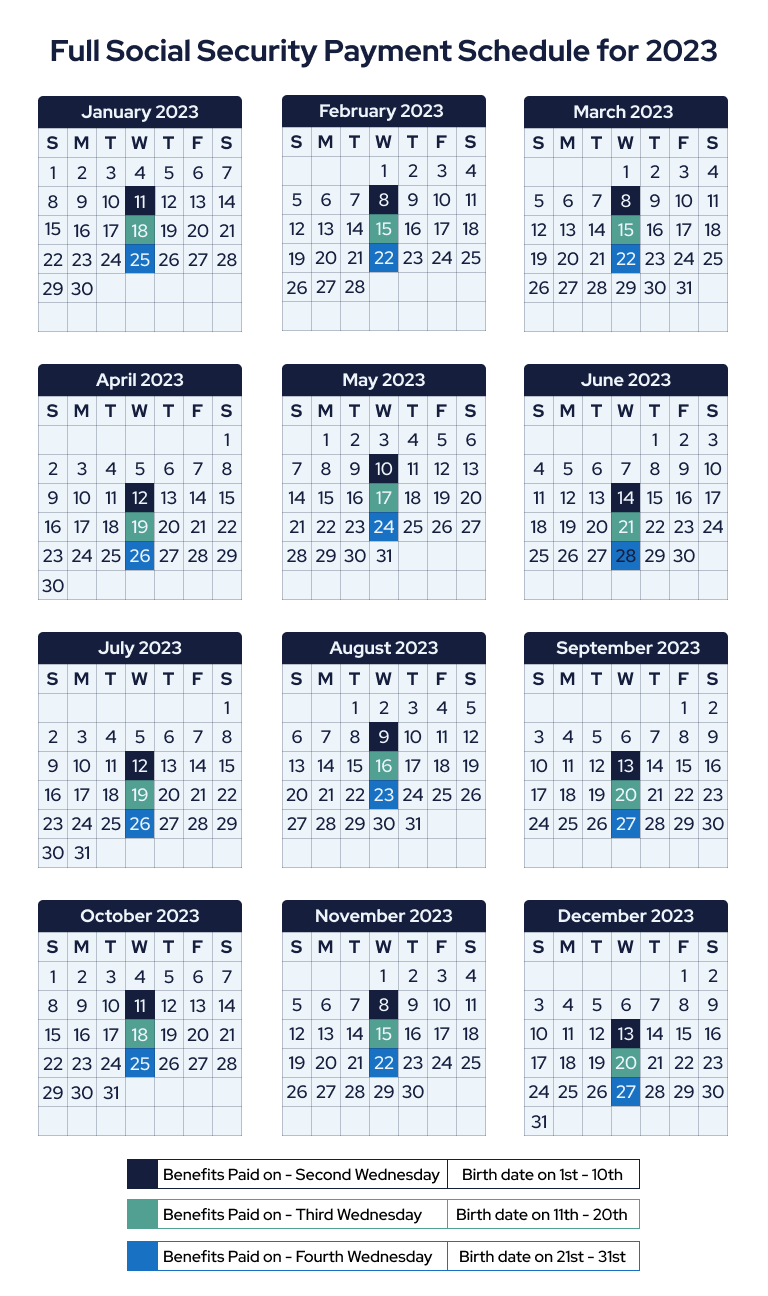

Schedule of Social Security Payments for January 2023 Direct Express, 2024 social security benefit payment calendar. See when 2024 supplemental social security payments will be sent and how to receive them.

Source: 2023vfd.blogspot.com

Source: 2023vfd.blogspot.com

21+ Social Security Payment For 2023 References 2023 VFD, (1) provisional income ($31,980) minus lower threshold ($25,000) times. What if my social security payment doesn’t arrive by the.

Source: www.denizen.io

Source: www.denizen.io

Calendar Of Social Security Payments Customize and Print, This is a comprehensive guide to the social security payment schedule for 2024 including an explanation of each social security program and the date you can expect your payment. Download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return.

Source: www.disabilitybenefitscenter.org

Source: www.disabilitybenefitscenter.org

Social Security Payment Schedule 2024 Important Dates, Social security taxes, funding the benefits, remain at 12.4 percent, but the income threshold subject to taxation will rise to $168,600 in 2024, up from $160,200 in. You’ll receive a social security payment for march 2024 on friday,.

Source: bunniqzaneta.pages.dev

Source: bunniqzaneta.pages.dev

2024 Social Security Withholding Limit Cammy Caressa, For people who started receiving benefits before may 1997 or people who receive both ssdi and ssi, the ssa will deliver ssdi. Here’s how i think of the calculation (using a single filing status from example 1):

Source: directexpresshelp.com

Source: directexpresshelp.com

Schedule of Social Security Payments for January 2023 Direct Express, 2024 pay chart for ssdi and ssi. Americans are set to receive a social security check worth up to $4,800 today, but not all seniors are happy about the increase in monthly payments.

Beneficiaries Who Started Receiving Social Security Benefits Before May 1997 Or Who Receive Both Social Security And Ssi Will Receive Their Payments.

The january 2024 supplemental security income (ssi) payment is mailed on december 29, 2023, since january 1 is a holiday.

If You File Your Income Tax Return As An Individual With A Total Income That’s Less Than $25,000, You Won’t Have To Pay Taxes On Your Social Security Benefits.

Supplemental security income (ssi) is an important source of income for people in need.